35+ does 401k affect mortgage approval

Web Lenders calculate your debt-to-income ratio by using these steps. For example child support and disability.

Suncorp Bank Retirement

In that case lenders are allowed to count that income as worth more.

. Web Elimination of Interest. Web Unfortunately you cover the expenses of PMI although it provides you with no personal protection. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Is this going to affect our. Most lenders do not. A 20 down payment is also useful because it.

Web Pre-paying their mortgage beats making 401 k contributions in terms of lifetime discretionary spending by 9195. Lowest Rates Easy Online Process. Web Double check with a loan officer but mortgage applications only take gross income into account so a deduction wont affect your dti.

Web Reduced investments if you pull from your 401 k Improved cash flow. Web We were just pre-approved on a loan and weve been very vigilant with our credit but I need to make changes to my 401k contribution. When applying for a mortgage loan the lender will evaluate your debts and income to determine if you are eligible for a loan.

Another advantage of withdrawing funds from a 401 k to pay down a mortgage balance is a potential reduction in interest payments to a. Makes it easier to. Web Some kinds of income are not subject to taxes.

For the poorer and richer couples there are. Be sure to list all of your cash and cash equivalents on your mortgage application. If you get a personal loan or co-sign a loan for someone else you could also face hiccups before getting to the closing table.

1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. Best Mortgage Lenders in West Virginia. 425 7 votes Most lenders do not consider a 401 k when calculating your debt-to-income ratio hence the 401 k loan may not affect your approval for a mortgage.

Borrowing from a 401k will count against you when buying a house. Web A 401k loan doesnt affect getting approved for a mortgage and your credit does not suffer for it. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Using a 401 k loan to pay off your mortgage.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. You can calculate your DTI ratio by dividing your recurring minimum expenses by your total monthly. These assets include any cash you have on.

Comparisons Trusted by 55000000. Taking out a personal loan. Best Mortgage Lenders in West Virginia.

Improved equity in your home. 445 42 votes. If youre taking out a 401k loan in the hopes of making your down payment.

Web Most lenders do not consider a 401k when calculating your debt-to-income ratio hence the 401k loan may not affect your approval for a mortgage loan. Cash And Cash Equivalent Assets. Taking money out from your 401 k in the form of a loan will likely do your retirement savings less damage than a.

However the lender will. Web Lenders usually look at your DTI ratio as a percentage. Lenders consider 401k loans to be a debt and even though you are repaying yourself.

Also mortgage apps usually. Comparisons Trusted by 55000000. Lowest Rates Easy Online Process.

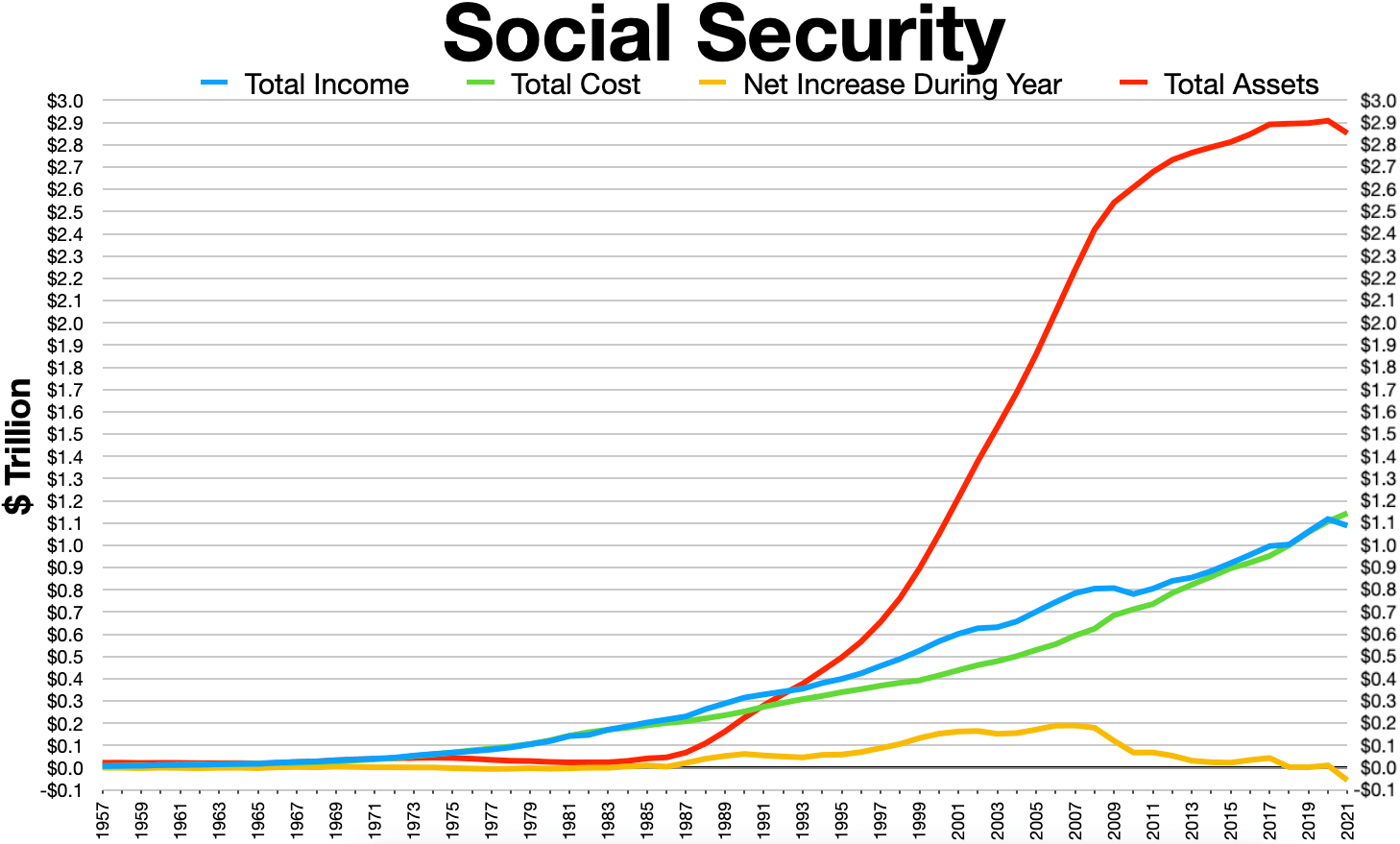

Social Security United States Wikipedia

Beware Of Passive Investing Index Funds And Etfs Post Moass Growing Wrinkles With Michael Burry Weekend Of June 11th 2021 R Superstonk

Invoice Factoring Everything You Need Moneyunder30

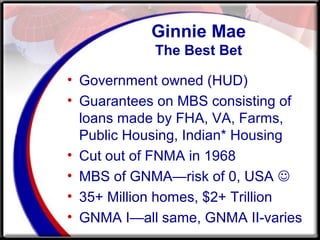

A Main Street Perspective On The Wall Street Mortgage Crisis

How Your Business Affects Your Net Worth Moneyunder30

Social Security United States Wikiwand

Is A 401k Considered An Asset For Mortgage Qualification

Better Example Against Double Taxation Of 401 K Loans My Money Blog

The Week On Wall Street The Search For A Bottom Nysearca Spy Seeking Alpha

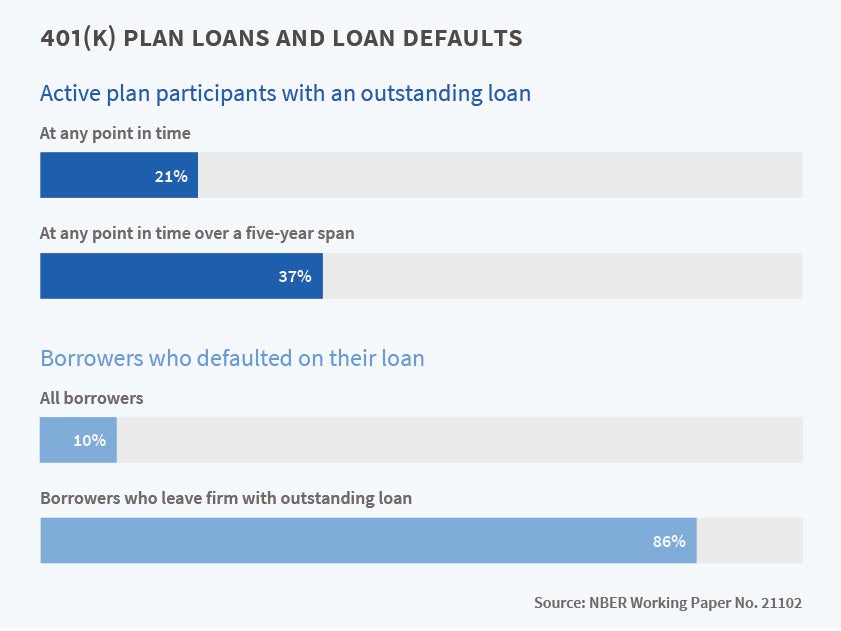

Do 401 K Loans Affect Mortgage Applications Smartasset

Five Tips To Increase Your Credit Score Quickly Mortgage Rates Mortgage Broker News In Canada

The 6 Best Payment Apps For Freelancers Moneyunder30

Borrowing From 401 K S Nber

Retirement Plan Loans 20 Questions Dwc

Member Spotlight

A Main Street Perspective On The Wall Street Mortgage Crisis

401 K Home Loan Rules Movement Mortgage Blog